Why the impact of Revenue Management has yet to peak

I. Revenue Management started with simple principles

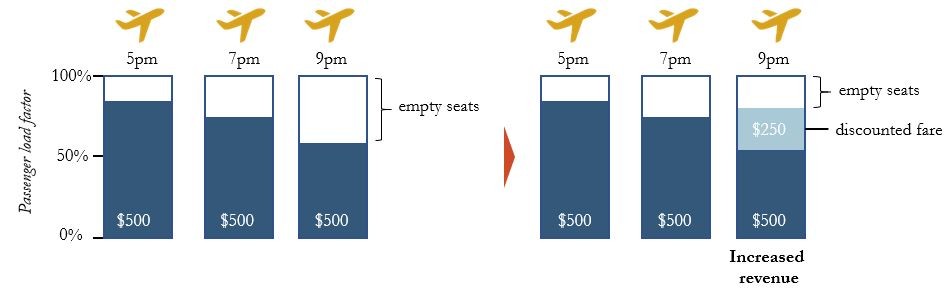

Revenue Management began when airlines noticed that offering discounted fares on some flights where spare capacity was available could increase revenue. This worked well as long as those reduced fares were not targeted at high willingness-to-pay customers – ie. usually business travelers. Indeed, offering them discounts does not stimulate demand but decreases the mean price – and affects revenues.

Targeting low willingness-to-pay customers meant offering early-bird, non-refundable discounts that business travelers would not be able to get (since they usually require flexible fare conditions and do not book very long in advance).

Demand from price-sensitive leisure travelers, however, was strongly stimulated and revenue rose sharply.

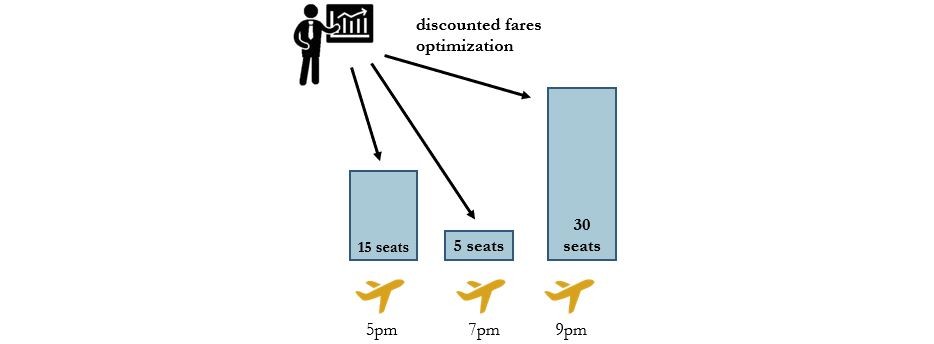

But discounting empty seats required to choose the right flights with spare capacity.

Since spare capacity is limited, discounted fares – that were supposed to fill this spare capacity – also had to be offered in limited, well adjusted, quantities.

Because discounted fares allocations had to be set in real time and on a vast amount of flights, softwares were created to allow airline staff to choose where and when those fares should be offered.

Analysts engaged in continuous re-evaluation of the placement of the discounts to maximize their use. This technique was widely admired as a very simple way to yield higher profits, with revenue growth of more than 10% in many cases.

II. But it quickly grew much more complicated

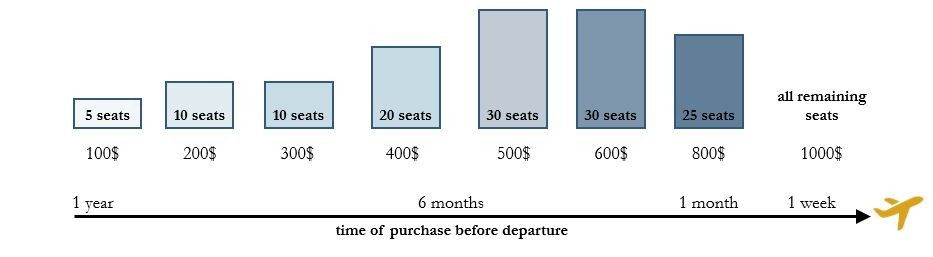

As the system grew over the following decades, more price points were created to increase the perimeter and the benefits of this new method. The former “standard fare” grew much higher to become a “maximum fare”, while “discounted” fares would cover a much higher share of sales.

A the end, almost all passengers got an optimized fare depending on their profile, flight time, number of days before departure, etc.

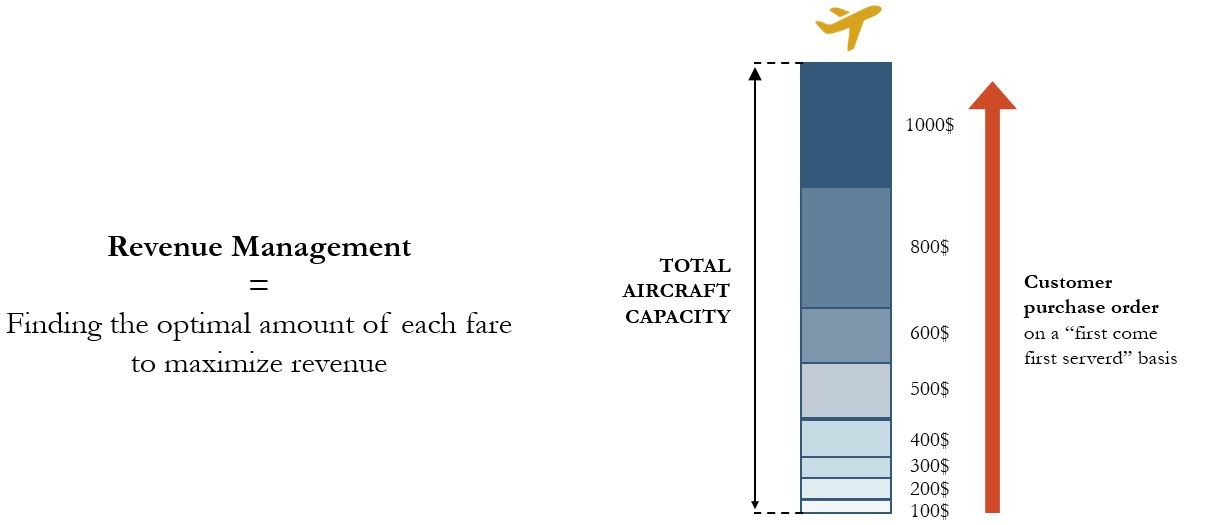

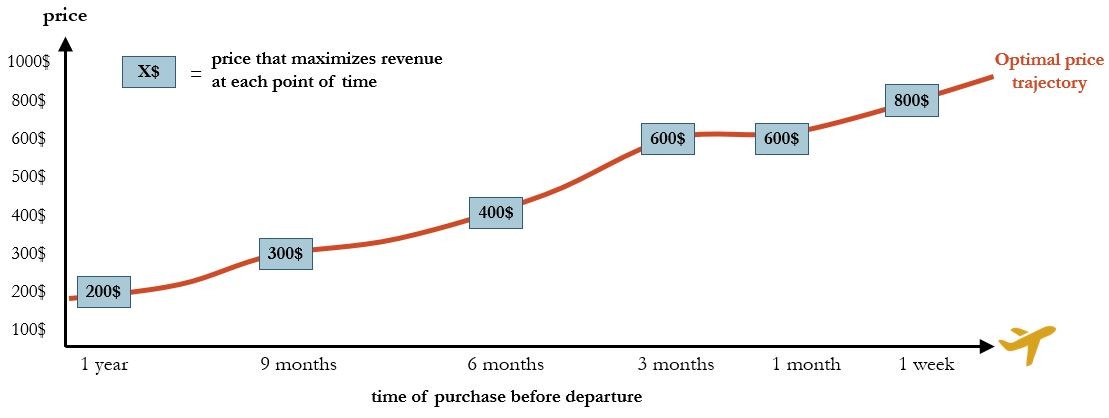

Today, a vast majority of Revenue Management departments spend most of their time trying to find out what optimal amount of each discounted fare should be offered on each flight (or train, bus, etc.), and splitting flight capacities into numerous levels of discount volumes. Customers then purchase these discounts from the cheapest to the most expensive on a “first come, first served” basis. This mechanism ensures that, unless an analyst makes some manual changes, the price of a given flight is automatically and naturally increasing over time.

For the Revenue Management analyst, the core challenge was to find, for each flight and at each point in time, the right tradeoff between :

- a too low price that would attract more customers but erode mean price so much as to decrease revenue,

- a too high price that would deter too many customers and thus decrease revenue as well.

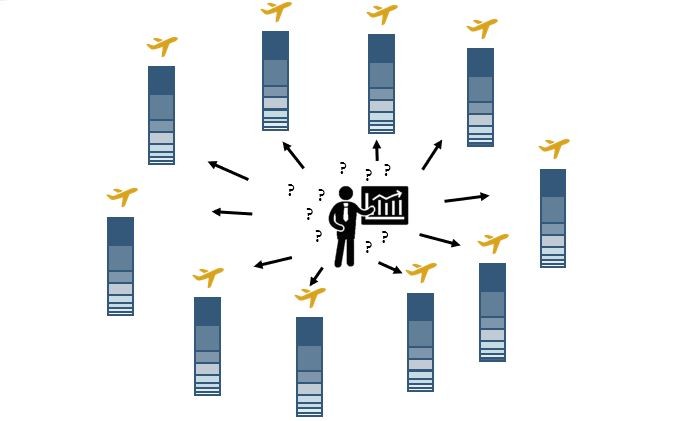

As the industry expanded and competition intensified, solving this trade-off became increasingly difficult. The system also progressively grew very complex to steer due to the rising amount of data required to improve it. Using mathematical tools to find the optimal pricing solution often led to unsolvable models for at least 3 reasons :

- the sheer volume of variables that can affect optimal pricing (aircraft capacity, departure hour/day, time of the year, competition pricing, weather forecast, local events, etc.)

- the interdependency between these variables : if you increase the 7pm flight price, will it affect demand for the 9pm flight that becomes comparatively cheaper?

- the difficulty to forecast future sales, essential when seat capacity is limited to tradeoff between selling a seat today to a lower price vs. selling it later to a higher price (with a lower probability, though)

Since no human brain was able to calculate accurately the optimal price allocations, the optimization process had mostly been based on intuition and insights gained through experience, intuitive historical data analysis, and sometimes a “test and learn” approach (the “learn” being strongly limited by the fact that there’s no quantitative way to measure ex post and compare the efficiency of different pricing strategies).

Some modern Revenue Management tools brought statistical methods to model “unconstrained demand” (ie. expected number of bookings, for each possible price level, assuming there is no capacity constraint), and help Revenue Management analysts to optimize the revenue. This kind of technique usually works reasonably well on simple markets with highly repetitive demand, but is quite inefficient in most other situations.

Although measuring the opportunity cost of using intuition-based or statistical-based techniques is in itself difficult, the optimization potential of Revenue Management was probably far from being reached.

III. What’s coming next

The last decade has brought a new powerful technology to explore a complete new way to optimize revenue : Machine Learning.

The starting principle is straightforward : instead of trying to model demand through complex and unsolvable models, Machine Learning simply allows to “learn” unconstrained demand patterns from vast amount of historical data. The result of this process allows to forecast the expected amount of passenger on any given flight, any number of days before departure, at any price level, and thus calculate the price that, in a given situation provides the best trade-off between price and passenger volume, in order to achieve the highest revenue.

A standard linear solver then only needs to use this day-to-day forecast to calculate what, throughout the entire sales duration of a flight, and taking capacity constraint into account, the optimal price trajectory is.

This approach, when combined with above system of discounted fares volumes that customers purchase in an increasing order on a “first come, first served” basis, still raises a few challenges :

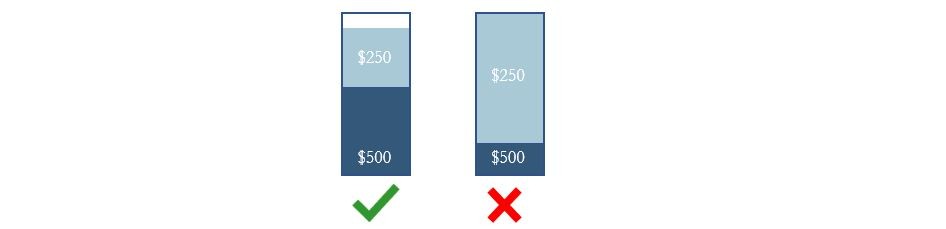

- Translating a price trajectory into a set a discounted fares volumes requires to forecast the speed at which each discount level will deplete very accurately, in order to guarantee that each discount level will be available at the right time (if sales happen to be slower than forecasted, for instance, discount fares will remain available for longer and business travelers might be able to get them). A possible fix is to re-run the above optimization process frequently, taking the latest sales trends into account.

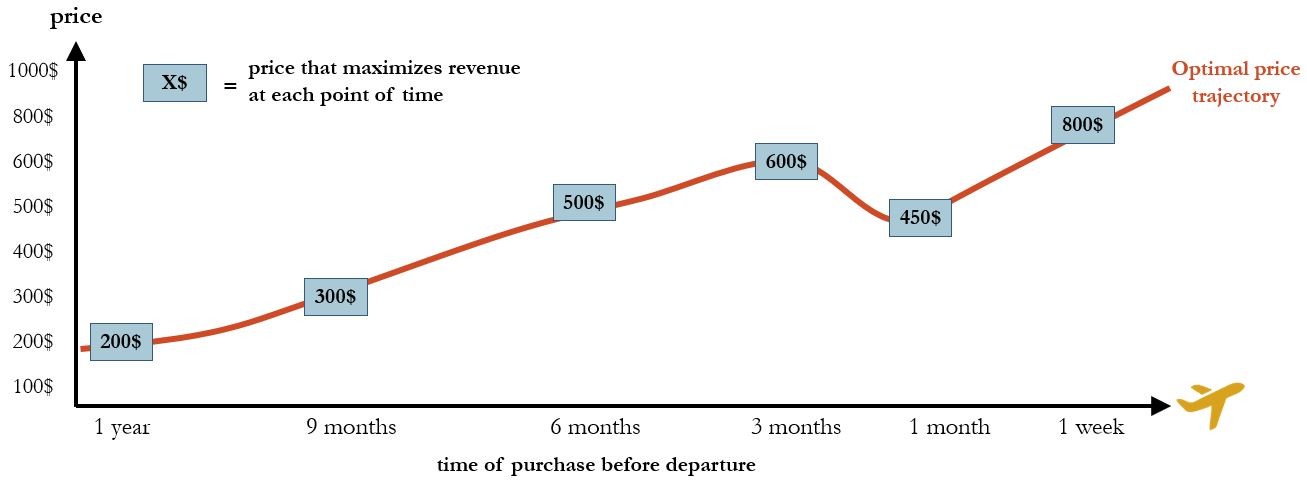

- The optimal price trajectory is not always an increasing curve : in some cases the fare that maximizes revenue 1 month before departure, for instance, is cheaper than 6 months before departure. However, the “first come, first served” discount structure doesn’t allow any price decrease. A possible fix is to re-run the optimization process frequently, and allow it to re-open discount levels that had already been depleted. Decreasing prices might however irritate some customers with earlier, more expensive bookings, who thought that booking early had allowed them to secure the best possible fare.

- Competitition pricing is a key forecast influencer, but is very difficult to predict more than a few days in advance. If the competition landscape is dense, it’s strongly recommended to re-run the optimization process frequently to allow the forecast algorithms to take the latest available competitor data into account, and update discount levels accordingly.

The bottom line is that optimization needs to be updated as frequently as possible, and that the short-term price trajectory (for a couple of days maximum) is actually always what matters most. Long-term price trajectory is more uncertain to predict and will have to be updated anyway later on, using fresh data.

This focus on the short-term price levels means it adds little value to waste too much time splitting the entire remaining flight capacity into multiple volumes of discounted fares. Powerful optimization algorithms may just calculate and update the current price on a daily basis. The sole potential purpose of setting future discount levels is to secure the risk of abnormally high sales occurring on a single day (e.g. a group sale) at a price level that was not meant for such a high volume (future and more expensive discount levels then become automatically available when cheaper discounts have depleted).

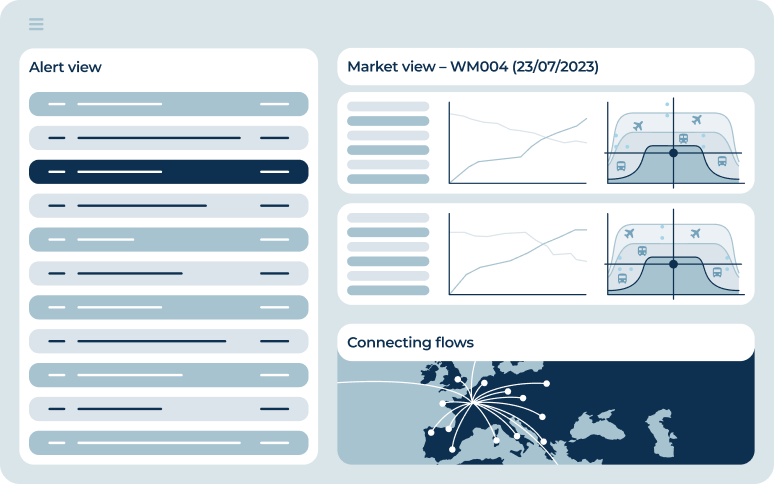

Machine Learning forecast and optimization not only yields significantly higher revenues through more accurate and frequently updated price levels, but also allows the Revenue Analyst to save time and focus on higher-value tasks, such as analyzing the forecast accuracy and adjusting it if necessary.

If you want to find out how to achieve efficient revenue optimization, Wiremind would be happy to help. Feel free to contact us!

Wait a sec! Interested in a quick demo?

Witness how Wiremind's optimization solutions can supercharge your operations.

Book a demo